ACG Card Services is one of the big platforms which makes out your online payments much more easier than any other banking card services.

So if you register these services and login to their account you’ll be then able to access all the files and banking statements related to your AAA account instantly.

The creditor and issuer of ACG card services are U.S Bank NA dba ACG card services. Very popular bank in the United States.

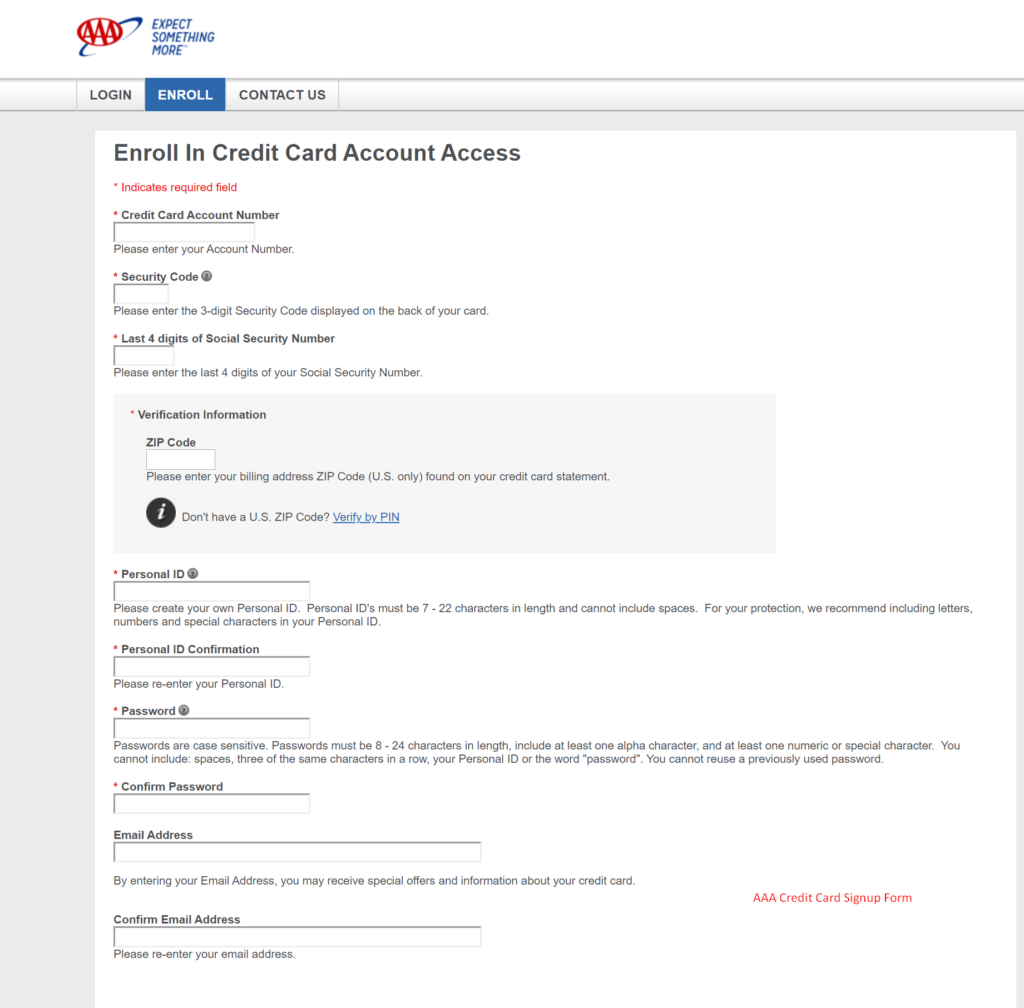

Getting Enrolled in AAA Credit Card Account Access

So if you want to get into the AAA credit card Account Access then definitely you need to Enroll to the ACG card Services. For getting enrolled in the services, you need to follow out some simple steps.

- First of all click on this link to get enrolled for the process

- And next what you have to do is like fill in all the details asked out by them.

- Make sure you have to fill in all the numbers indicated in red mark

- The first detail that you need to enter is Credit Card Account number which will be given to you when you have got the credit card.

- Next is you have to enter the security which will be in the back of your credit card and it will be like in three numbers.

- After that you have to enter the last four digits of your Social Security Number.

- Next for verification process, you have to provide the zip code and the code you have to provide is like ZIP code of your billing address which can be found out in your credit card statements.

- Now you have to enter your personal Id, if you don’t have one you can create a new one and make sure it is a mix of letters, numbers and special characters.

- Also the personal Id must be like 7-22 letters, and also it should not have like any spaces.

- Then once again enter out your personal Id for conformation.

- Next one is the most important one and that is your password, there are like certain thing you need to follow out for having a great password.

- And that is you need to choose a password which is like 8 – 24 characters in length and also it should include at least one alpha character, one numeric and one special character.

- There are also things which you cannot include it in your password they are spaces, three of same characters in a row, your personal id and the word Password and your old password.

- Next is you need to enter you email id and once again enter the email id for the confirmation.

by following the simple steps above, You can get the acgcardservices com activated.

Get AAA Credit card Account overnight

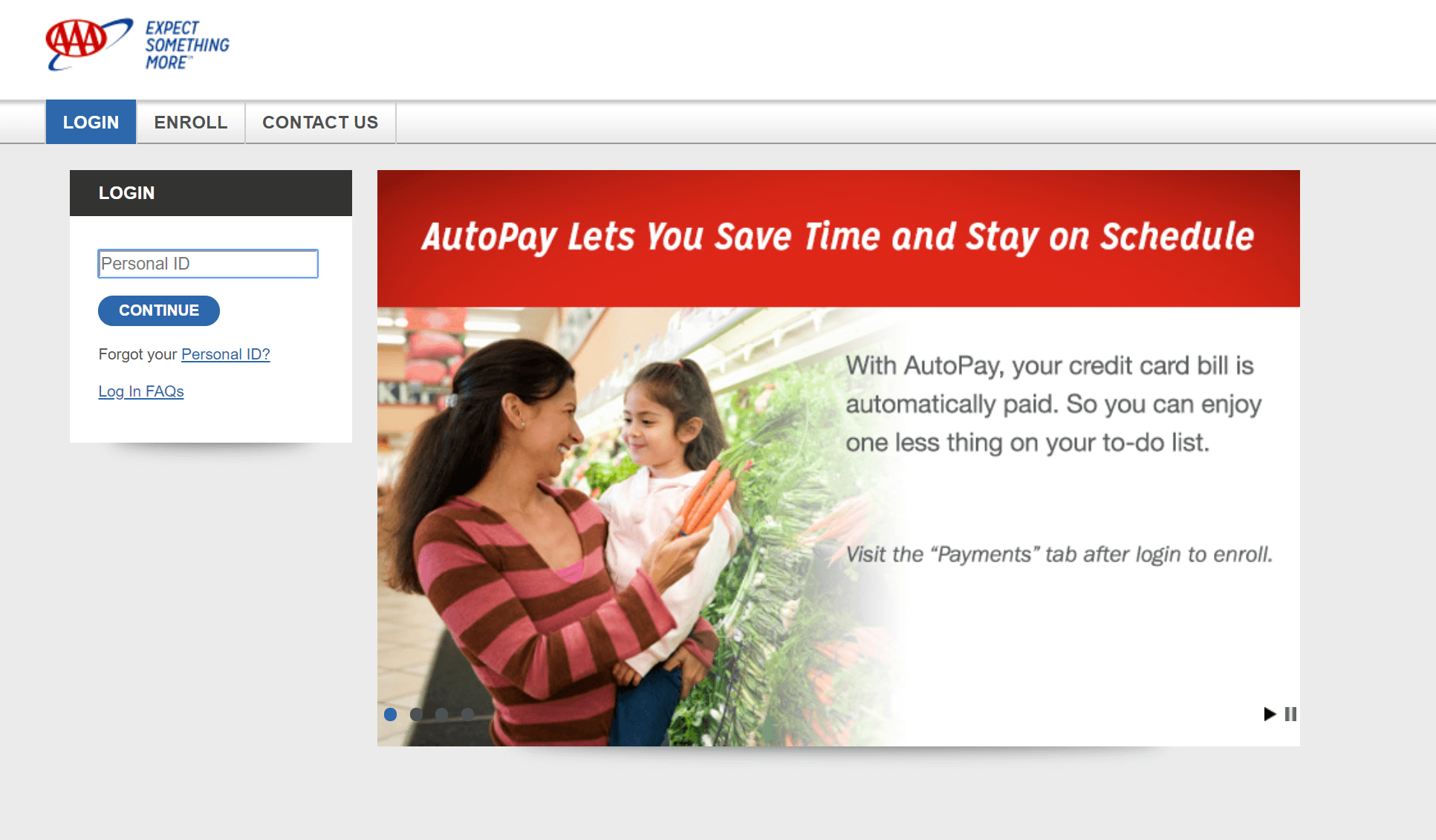

ACG Card Services Login / AAA Credit Card Login / AAA Mastercard card Login / AAA Login

Follow out the steps given out below for a smooth login into the ACG Card Services

- First, click on the link and then get into the login page.

- When you log in you can get access to your account and make out the online payments.

- Also you can check out and take out the statements that you wanted.

- For logging in you need to enter out your personal id and then press continue.

- After that you’ll be logged on into the acgcardservices my online account, next there you can see your aaa account page where you can be able to manage everything related out to your accounts.

AAA Credit Card Payments – acgcardservices bill pay

We have lots of options being available with our Payments method, first of all you can make the same day payment of anything you wanted to do.

Also we have an another option that if you are busy on certain time and want to make payment at that time then you can like schedule your payment for that certain time period or else you can sign up for autopay where your payments will be done automatically on every month on the same day as you want.

Your Triple A credit card helps you in either way.

Paying Bills – AAA Bill Pay Login

So if you want like to make bill payments like kind of automatic bill payments then this is definitely gonna help you for sure.

- First of all check out whether the medium you want to make automatic bill payments is accepting the process of automatic bills.

- And if so then provide the 16 digit credit card no of yours and then set up the date of every month that you want to make bill payments.

- Also make sure to limit the amount of money to charge by them because sometimes like some provide will charge more than like what you expected, since you have already authorized us to make payments we also allow them to choose the amount they wanted. And that’s why if you set out the payment limit then they won’t be able to charge more than the limit.

- We hope with this your AAA Credit Card payment has become very easy.

Digital Payments

Now it’s a more technological world actually and lots of technological advancements have been made now and even the usage of credit cards has been reduced for making payments nowadays and that’s why we have been supporting digital payments supports in our services.

So our mobile digital payments is completely safe and you don’t need to have get worried about the problems getting your card no stolen and all also it will reduced the issue of searching for right card to make the right payment.

Here are the digital payment methods that we are actually accepting

- Fitbit Pay.

- Garmin Pay.

- Google Pay.

- Apple Pay.

- Samsung Pay.

AAA Cards and Rewards – acgcardservices.com/myoffer

So we are actually providing lots of rewards to our credit card holders and since people has been using out cards based on different purposes we been providing out three different cards for the convenience of the users namely

- AAA Dollars Mastercard.

- AAA Dollars Plus Mastercard.

- AAA Dollars Gas Rebate Mastercard.

Read More About AAA Dollars Cards and Rewards

AAA Dollars Mastercard

Here are the few aaa credit card benefits. For this card you’ll be like earning 1% of the total purchase that you been making in the month and like it be wherever this card is been accepted

And you can redeem out this card by using

- AAA Gift Cards.

- Statement Credit.

- Cash Back.

- Merchant Gift Cards.

- Charitable Donations.

AAA Dollars Plus Mastercard

- For this card there is no limitations on the AAA rewards that you earn.

- Also you can earn like 3% on all travel purchases.

- And also like 2% on gas station, grocery and drug store purchases.

- Along with nearly like 1% on all other purchase that you’ll be making with AAA dollars Plus Mastercard.

AAA Financial services credit card also has more benefits.

AAA Dollars Gas Rebate Mastercard

So this is like a special card that’s been given out to all for making gas purchases like who been doing more, its mostly a card that’s been issued out for the truck drivers kind of like that.

- You can earn like up to 5% on every gas station purchases and your gas rebate is automatic and then it’ll be appear as an credit.

Security and Features

We all know that nothing in this world is safe and when it comes computer and credit card kind of things everything is very unsafe. There are lot of possibilities for you to fall under the fraudulent things and became a victim of being getting stolen.

That’s why we are valuing the safety of you guys very much than any other people. For that you need to follow out certain things actually like.

- Create out a password that is very difficult to be stolen and like a password that’s been very much stronger.

- Also don’t use out your same user ID as your password, make a separate one for each of them.

- Particularly don’t share your password with anyone, in some rare cases share it out with the ones that you trust the most.

- Also don’t carry out your passwords anywhere like being written in books kind of something.

Worried about ACG Services Security?

AAA credit card phone number

If you have any troubles in accessing the card, Please contact the customer support number 1-800-807-3068

Our Chip Card Technology

All of your cards are being provided with an embedded chip which will gonna give you a much more security when you make out a purchase at chip-enabled terminal.

The tiny chip being available in this card is the one that’s gonna prevent you from fraudulent things by making new unique codes for each transaction that you make.

With our technology now you don’t need to worry about your transactions just make out the ones you want like anywhere without any fears.

Even though if you have already get caught you can easily get back with us through our customer support, and we are always out here to help you.

But make sure that you get back to us as soon as you have to get caught because it will tougher for us to get back the money if you have delayed out the process.

Also if you are kind of doing transactions out by using your smartphones then you gonna do certain things to make it much safer like creating out a strong user pin for doing any kind of transactions.

Make sure to not share any OTPs/Codes which you received on your mobile with anyone else. By equipping the best practises we can enjoy the ACGCARDSERVICES and get benefits from it over a long time.